Acct Which of the Following Requires Recording for Contingent Liabilities

With a 60-day 3000 note bearing 5 annual interest. A provision is a liability of uncertain timing or amount.

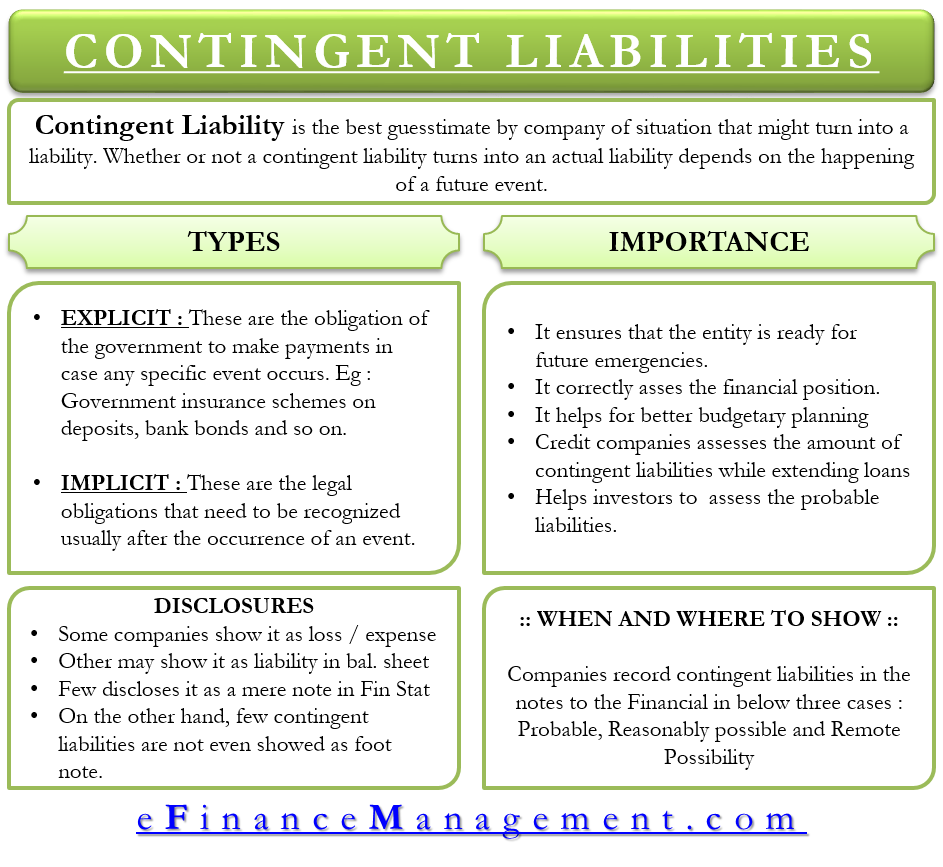

What Is A Contingent Liability Accounting Questions Answered

The liability is probable and estimated to be 40000.

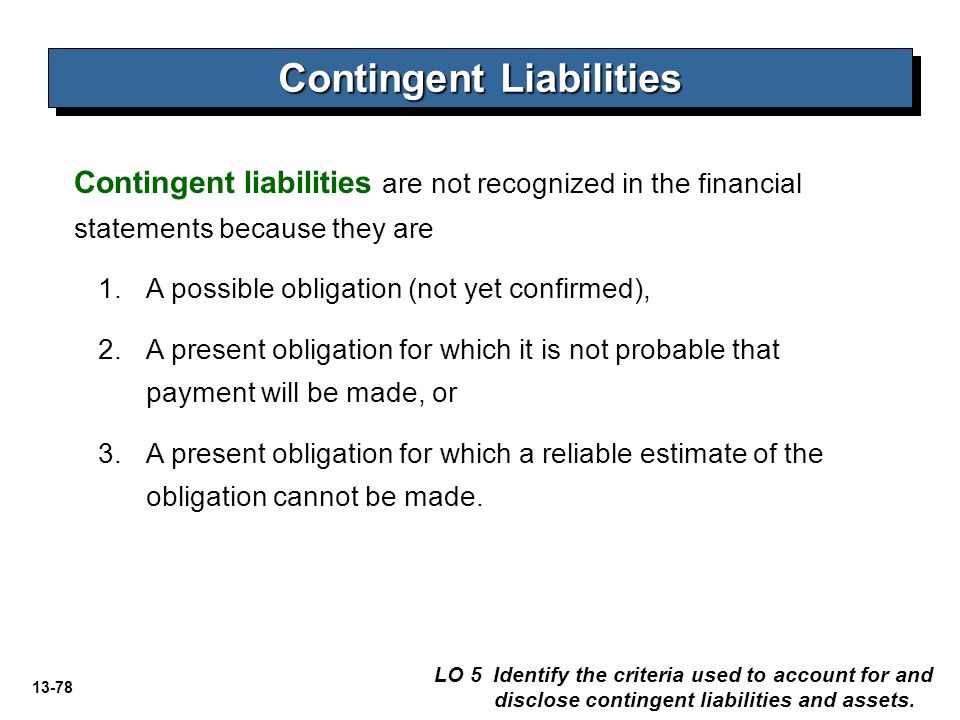

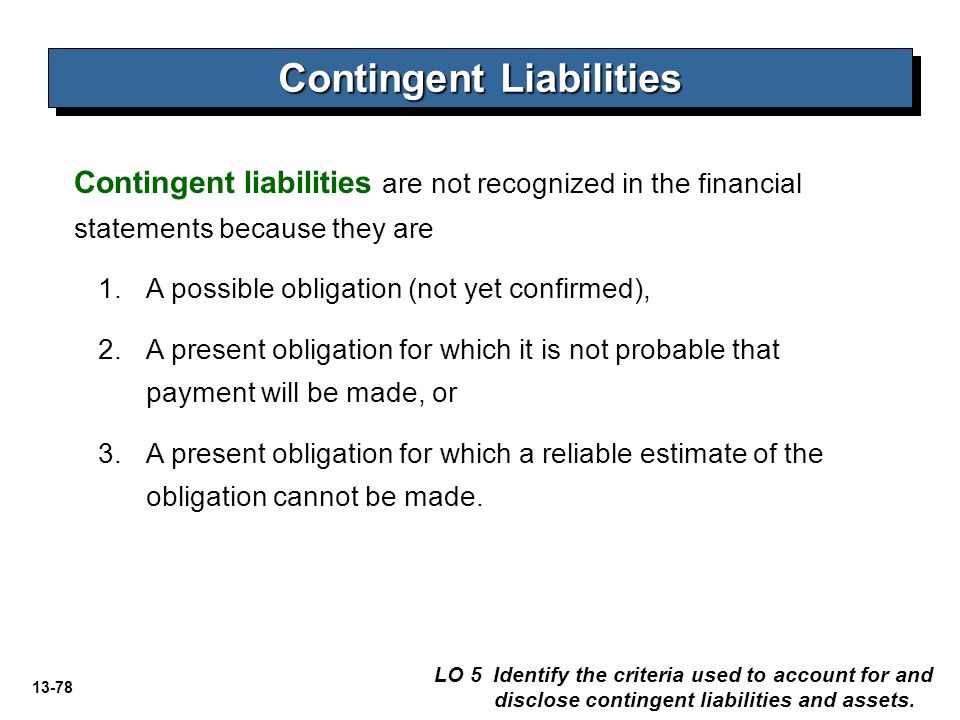

. A past event has occurred but the amount of the present obligation if any cannot yet be determined. The outcome is probable and the potential liability can be estimated. To record a potential or contingent liability in the financial statements it needs to clear two basic criteria based on the probability of occurrence and its related value as discussed below.

Other examples include guarantees on debts liquidated damages outstanding lawsuits. If the liability is likely to occur and the amount can be reasonably estimated the liability should be recorded in the accounting records. Replaced a 3000 account payable balance to Fiona Co.

The liability may be a legal obligation or a constructive obligation. In fact 469 of the 957 companies contacted in the AICPAs annual survey of accounting practices reported contingent liabilities resulting from litigation. Chapter 8 and 9 Quiz answers in bold Which of the following requires recording for contingent liabilities.

On the other hand if it is only reasonably possible that the contingent liability will become a real liability then a note to the financial statements is required. With a contingency the uncertainty is about the outcome of an action that has already taken place. A constructive obligation arises from the entitys actions through which it has indicated to others that it will.

Angela Bennett is an employee of Marks Co. IAS 37 outlines the accounting for provisions liabilities of uncertain timing or amount together with contingent assets possible assets and contingent liabilities possible obligations and present obligations that are not probable or not reliably measurable. The accountant is not a fortune teller who can predict the future.

All contingent liabilities must be included in reporting. The following two examples from annual reports are typical of the disclosures made in notes to the financial statements. The riskiness of a businesss obligations.

A contingent liability is recorded in the accounting records if the contingency is probable and the related amount can be estimated with a reasonable level of accuracy. Payment amount is probable and can be reasonably d. Recording of a contingent liability.

All contingent liabilities must be included in reporting The outcome is possible. Chapter 8 9 Quiz Which of the following requires recording for contingent liabilities. Estimation of the value of the contingent liability is possible.

IFRS requires a liability to be recorded as a present value amount. The outcome is possible. A is a sellers obligation to replace or fix a product or service that fails to perform as expected within a specified period.

Niwas entry to record this transaction would include which of the following entries. Likewise a note is required when it is probable a loss has. Disclosing a Contingent Liability A loss contingency which is possible but not probable will not be recorded in the accounts as a liability and a loss.

Credit to Cash Debit to Cash Credit to Notes Payable Debit to Notes Payable Debit to. The outcome is probable and the potential liability can be estimated. A potential or contingent liability that is both probable and the amount can be estimated is recorded as 1 an expense or loss on the income statement and 2 a liability on the balance sheet.

Provisions are measured at the best estimate including risks and uncertainties of the expenditure. If a contingent liability is deemed probable it must be directly reported in the financial statements. Choose all that apply a.

Which of the following requires recording for contingent liabilities. GAAP a contingent item should be recorded as a liability if the loss or outflow is probable and can be reasonably estimated. The liability is possible and cannot be reasonably estimated.

The liability is remote and estimated to be 15000. Many contingent liabilities arise as the result of lawsuits. The outcome is probable but an estimate cannot be given.

4 Nevertheless generally accepted accounting principles or. Check all that apply Multiple select question. In order for a contingent liability to be recorded as a journal entry in the financial statements it must be probablereasonably possibleremote and reasonably estimable.

Record a contingent liability when it is probable that a loss will occur and you can reasonably estimate the amount of the loss. Payment amount is reasonably possible and can be reasonably estimated b. International accounting standards focus on recording a liability at the midpoint of the estimated unfavorable outcomes.

IAS 37 defines and specifies the accounting for and disclosure of provisions contingent liabilities and contingent assets. Rules to Record Contingent Liabilities as per IFRS. Abbott Corporation should record a contingent liability and loss of 400000 When a contingent event that may give rise to a future loss is likely to occur it is said to be.

In order for a contingent liability to be recorded as a journal entry in the financial statements it must be probablereasonably possibleremote and reasonably estimable. The likelihood of occurrence of contingent liability is high ie more than 50 and. If you can only estimate a range of possible amounts then record that amount in the range that appears to be a better estimate than any other amount.

The threshold for recording items as. View Ch8-9 Quizpdf from ACC 107 at Eastern Gateway Community College. An IOU promising to repay the amount borrowed plus interest.

Mixture of liabilities and equity a business uses. A contingency poses a different reporting quandary. Which of the following contingent liabilities would require a company to record a note to the financial statements.

The most common example of a contingent liability is a product warranty. The outcome is probable but an estimate cannot be given. If no amount is better then record the lowest amount in the range.

Define And Apply Accounting Treatment For Contingent Liabilities Principles Of Accounting Volume 1 Financial Accounting

Current Liabilities Provisions And Contingencies Ppt Download

Contigent Liabilities Meaning Types Examples Commerce Achiever Commerce Achiever

Comments

Post a Comment