Which of the Following Would Normally Involve Long Term Financing

In contrast to long-term notes which usually mature in 10 years or. Long term loans are generally over a year in duration and sometimes much longer.

View the full answer.

. A expanding current inventory b workers salaries c unanticipated emergencies d purchase of modern equipment. Many small businesses rely on factoring as a source of short-term financing. As is obvious long-term financing is more expensive as compared to short-term financing.

Ploughing Back of Profits 4. One-year or greater in length. One year to 10 years in length.

Long-term financing is used for major purchases or projects that are financed for a. It is the most important. A Workers salaries B Unanticipated emergencies C Purchase of modern equipment D Expanding current inventory A Workers salaries.

Expanding current inventory Feedback. Long term financing are. Which of the following BEST defines long-term financing.

All funds to be invested in various types of fixed assets plus in hard core working capital are to be considered as long-term financial needs. Purchase of modern equipment D. 193 Long Term Finance Its meaning and purpose A business requires funds to purchase fixed assets like land and building plant and machinery furniture etc.

Which of the following would normally involve long-term financing. Long term financing is a form of financing that is provided for a period of more than a year which may extends up to 30 years. Long term projects with positive social benefits include investments in transport and energy infrastructure hospitals universities industrial facilities eco-innovation.

Long term financing means financing by loan or borrowing for a term of more than one year by way of issuing equity shares by the form of debt financing by long term. Purchasing a building with a note is considered. Purchase of modern equipment.

Long-term financing is normally concerned with financing for which one of the following lengths of time. A bond is a long-term debt or liability owed by its issuer. Financing can be either long-term or short-term.

One-year or less in length. Answer 0 emerald2011 Which of the following would normally involve long-term financing. Long-term financing is defined as debt with a maturity due date of longer than one year.

Which of the following would normally involve long-term financing. This article throws light upon the three main types of long term financing. Purchase of modern equipment.

Long-term financing is used for major purchases. Multiple Choice Financing activities involve long-term liabilities and equities. Ii Medium-term financial requirements which are.

Which of the following would normally involve long-term financing. Some of the long-term sources of finance are- 1. Long-term financing matches the.

Mortgage financing is a perfect example of long-term financing. Which of the following would normally involve long-term financing. The correct answer is Option b long term liability and stockholders equity items this is because financing activities means.

Equity and Loans from Government 2. O Operating activities include the payment of dividends. Long Term Finance.

Loan from Public Financial Institutions 3. There are different vehicles through which. Three common examples of long term loans are government debt mortgages and.

This article throws light upon the seven major sources of long-term finance. Use of credit for a project that lasts at least six months Use of credit for a project that lasts over a year Use of credit that has a. These assets may be regarded.

Physical evidence of the debt lies in a negotiable bond certificate.

The Benefits Of Long Term Vs Short Term Financing

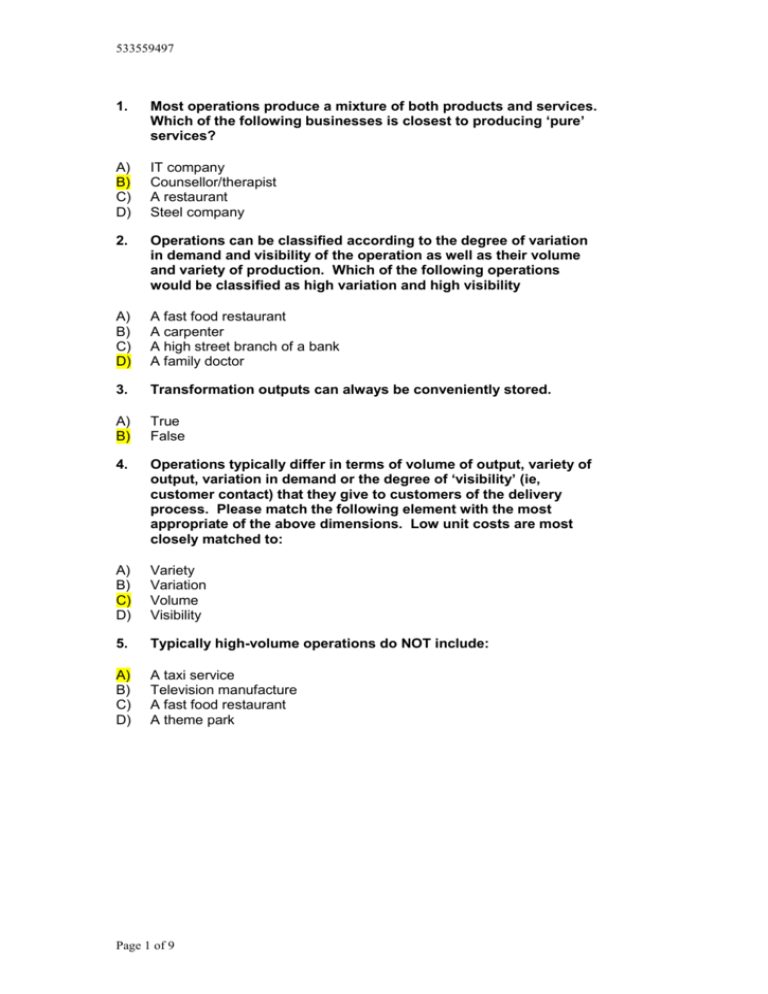

Answers To Multi Choice Session 1a Introduction To Operations

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

Comments

Post a Comment